Income tax law and Lawyers in Pakistan, including its objectives, progressive taxation, and tax services provided. Explore our comprehensive range of tax planning, compliance, and representation services offered by experienced professionals. Discover how we assist individuals, corporations, and other entities in navigating the complexities of income tax law in Pakistan.

Income tax law in Pakistan encompasses the taxation of income generated by individuals and businesses within the country. It is a crucial source of revenue for the government, enabling the funding of public services and fulfilling governmental commitments. As per the law, taxpayers are required to file an annual income tax return to determine their tax obligations. Understanding income tax law is essential to ensure compliance and make informed financial decisions.

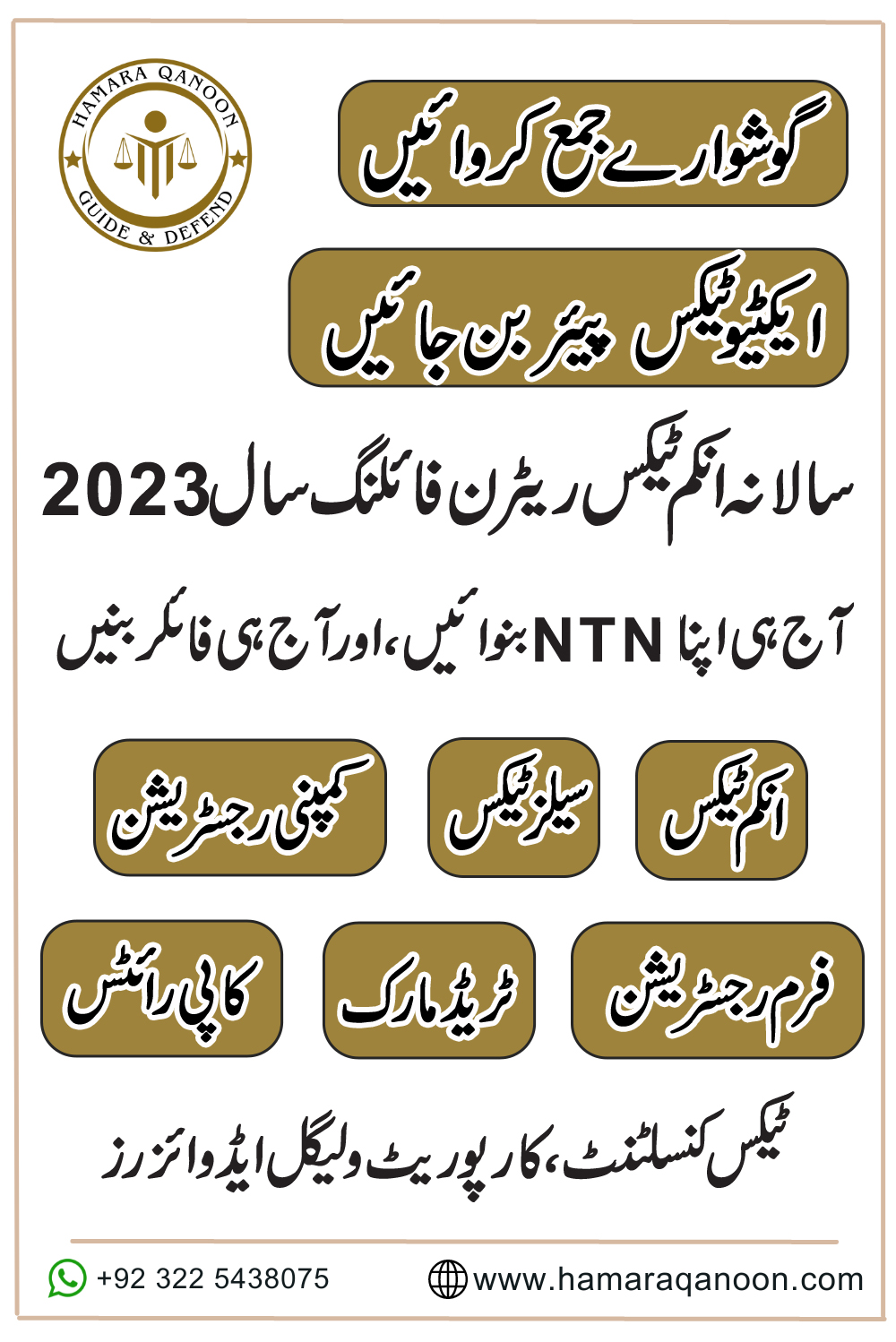

We offer a wide range of tax services designed to address the diverse needs of individuals and businesses. Our dedicated team of experienced income tax lawyers and consultants specializes in providing tailored solutions for corporate and individual tax planning. From the completion of income tax returns and compliance services to complex consultancy assignments and strategic tax planning, we are committed to delivering practical and effective tax solutions.

Progressive taxation lies at the core of income tax law, aiming to address economic inequality and promote wealth redistribution. By levying higher taxes on higher incomes, the tax system seeks to ensure fairness and reduce enduring differences in wealth and opportunities among individuals and economic strata. Additionally, income tax law serves as a tool for fiscal policy, promoting specific economic activities through exemptions and incentives.

Our range of tax law services in Pakistan includes:

In Pakistan, federal taxes are classified as direct and indirect taxes. Direct taxes primarily comprise income tax and are categorized based on different sources of income, such as salaries, business or profession, interest on securities, capital gains, and other sources. Personal tax rates for individuals range from 5% to 35% for the Tax Year 2022. Public companies are assessed at a corporate rate of 29%, while banking companies are taxed at a rate of 35%.

Wealth statement disclosure is mandatory under income tax law, providing a comprehensive view of an individual’s assets, liabilities, and expenditure. Foreign income and assets statements are required for residents with significant foreign income or assets. Inter-corporate dividend tax applies to various scenarios, including independent power producers, mutual funds, real estate investment trusts, and other companies.

Unilateral relief allows residents in Pakistan to claim tax relief on income earned abroad, considering taxes already paid in foreign jurisdictions. Our audit specialists deliver high-quality audits, combining rigorous risk assessment, diagnostic processes, and audit testing procedures. Our state-of-the-art audit system supports all phases of the audit process, ensuring accurate and reliable results.

Our investment advisory services offer expert guidance in analyzing investment prospects, managing risks, and designing effective strategies. We provide advice on conducting business in Pakistan, including legal entity formation, obtaining permissions, and dealing with local regulators. Our comprehensive services cover due diligence, feasibility studies, financial analysis, tariff and pricing studies, and more.

By choosing our experienced team of tax professionals, you can navigate the complexities of income tax law in Pakistan and optimize your tax planning and compliance strategies. Contact us today to benefit from our expertise and ensure tax efficiency for your personal or business interests.

Income tax is a tax imposed by governments on the income earned by individuals and businesses. It is calculated based on taxable income and serves as a source of revenue for the government to fund public services and infrastructure development. Taxpayers must file an annual income tax return to report their income and determine their tax obligations.

The limit for income tax audit varies based on the tax laws of each country. It is determined by specific criteria such as income thresholds and types of transactions. Consulting the relevant tax laws in your country will provide you with the accurate information regarding the limit for income tax audits.

TDS stands for Tax Deducted at Source. It is a mechanism used in income tax systems where a person or entity making certain types of payments is required to deduct a percentage of the payment as tax before making the payment to the recipient. The deducted tax amount is then remitted to the government on behalf of the recipient

Income tax rates in Pakistan are progressive, ranging from 0% to 35% for individuals. However, tax rates can change, so it’s best to consult with our professional tax lawyer for accurate and up-to-date information.

The tax on salary in Pakistan is determined by the individual’s income and the applicable tax rates. It follows a progressive system with rates ranging from 0% to 35% for different income brackets. However, tax rates can change, so it’s advisable to consult our professional tax lawyer for accurate information.